Use the copy of your tax return you gathered in Step 1 to complete this column. This column shows the numbers previously reported on your tax return. However, you'll first have to enter your information into TurboTax to match what you filed the first time, then start the process of amending it. If you didn't use TurboTax to file your tax return, you can use TurboTax to prepare the amendment.

TURBOTAX 2014 FILE AMENDED RETURN SOFTWARE

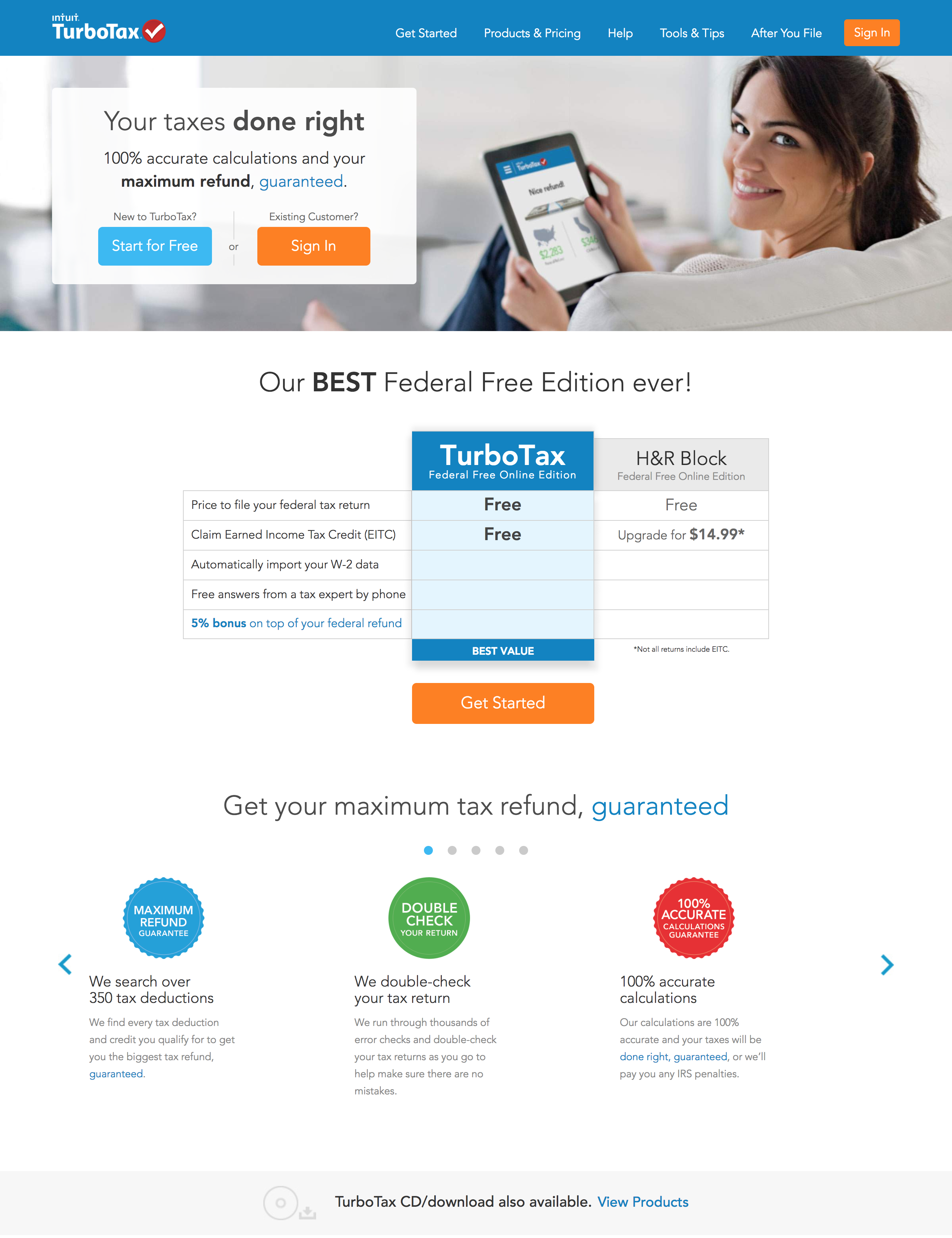

From there, the software will walk you through the process of filing the amendment. If you prepared your original tax return using TurboTax, log in to your account, open the tax return you already filed, and click on the link to amend your return. For example, if you need to amend your 2020 tax return, you need to use the 2020 version of TurboTax. To do this, you need to use the version of TurboTax that applies to the tax year you need to amend. You can also prepare your amended return in TurboTax. Updating your capital gains and losses will require Form 8949 and Schedule D, and so on. Changes to revenues or expenses from a trade or business will require Schedule C and Schedule SE. To amend your tax return to add additional interest or dividend income, you'll need a copy of Schedule B. For example, if you’re changing your itemized deductions, you’ll also need a copy of Schedule A for that tax year. You'll also need any forms that will be impacted by your change. The IRS form for amending a return is Form 1040-X. TurboTax Tip: When you file an amended return, you should include any new documents needed to support your changes, such as a new or amended W-2 or 1099 form to report additional income, a new or amended Form 1098 Mortgage Interest Statement, or a Form 1098-T to claim an education credit. Your transcript shows most of the lines from your tax return, including income, deductions, credits, and tax payments. If you didn’t file using TurboTax and can’t locate a copy of your return, you can order a copy of your tax transcript using the Get Transcript tool on IRS.gov.

TURBOTAX 2014 FILE AMENDED RETURN PDF

If you initially filed your tax return using TurboTax, you can access your tax return online or print a copy of that return by logging in to your account at TurboTax online or print a PDF of your return from the copy saved on your computer. If you missed claiming a tax deduction or credit, you’ll need documentation to support the new deduction you're claiming, such as a receipt for a charitable donation, new or amended Form 1098 Mortgage Interest Statement, or Form 1098-T to claim an education credit. If you need to correct the income you reported on your return, you may have a new or amended W-2 or 1099 form. Gather your original tax return and any new documents needed to prepare your amended return. The process for filing an amended return is fairly straightforward. If you're outside of that window, you can't claim a refund by amending your return. Within two years of paying the tax due for that year, if that date is later.

You usually don't need to file an amended return if you discover math or clerical errors on a recently filed tax return. You realize you claimed an expense, deduction or credit that you weren't eligible to claim.You forgot to claim taxable income on your tax return.You accidentally claimed the wrong tax filing status.You realized you missed out on claiming a tax deduction or credit.Here are some common situations that call for an amendment: There are times when you should amend your return and times when you shouldn't.

Here's what you need to know about filing an amended tax return. That's why the IRS allows taxpayers to correct their tax returns if they discover an error on a return that's already been filed.

0 kommentar(er)

0 kommentar(er)